Shariah Advisory & Consultancy

We help you align your financial practices with Islamic values and international Shariah standards—

ensuring credibility, trust, and long-term ethical success.

Adl Advisory possesses deep expertise in navigating the complexities of Shariah compliance, ensuring that your financial practices align with Islamic principles and prevailing regulations.

For Muslims, adhering to Shariah in financial matters is not optional—it is a religious obligation to ensure that one’s wealth is earned, managed, and spent in a halal and ethical manner.

This includes avoiding Shariah-prohibited elements such as Riba (interest), Gharar (excessive uncertainty), and Qimār (gambling), and upholding principles of justice, transparency, and shared benefit.

WHAT WE OFFER

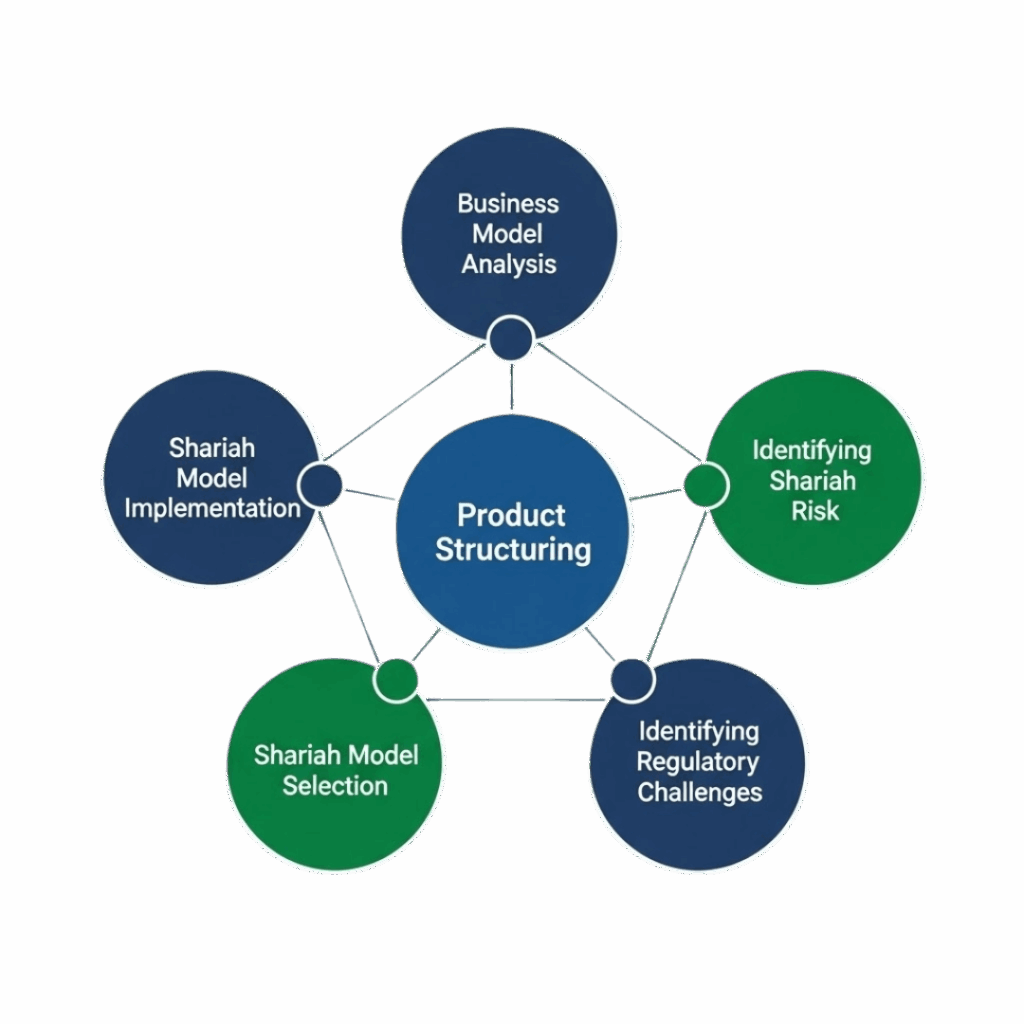

Designing financial products that fully comply with Shariah principles while meeting market demands.

Issuing formal rulings and scholarly insights to guide decision-making with authority and clarity.

Evaluating operations, policies, and documents to identify and rectify non-compliant elements.

Ensuring your activities are aligned with globally recognized frameworks and regulatory expectations.

Providing direction on business models, operational frameworks, and strategic planning.

Supporting clients across sectors—including finance, fintech, halal business, and non-profits.

OUR SERVICES

We deliver comprehensive, practical, and transparent Shariah solutions — helping institutions, businesses, and investors achieve full compliance with confidence.

OUR APPROACH

We begin by gaining a clear understanding of your goals, operations, and regulatory environment. This allows us to identify your unique Shariah compliance needs and tailor our approach accordingly.

Our team reviews your existing structures, processes, and documentation to assess alignment with Shariah principles. We then identify gaps and areas that may require restructuring or enhancement.

Based on our analysis, we offer practical, Shariah-compliant recommendations. This may involve restructuring products, contracts, or business models to ensure both compliance and commercial effectiveness.

When needed, we facilitate the issuance of formal Shariah opinions (Fatwas) and supporting documents—essential for regulatory filings, investor assurance, and market credibility.

Speak to Our Shariah Experts

Whether you’re developing a product, running an institution, or seeking a compliance review—Adl Advisory is here

to guide you with insight, authority, and integrity.

OUR APPROACH

Have a focused Shariah question? Get clarity fast through our Expert Shariah Scholars. If the matter needs deeper work, we transition you to full advisory.

We don’t stop at advisory. We provide ongoing Shariah audits, reviews, and certifications to ensure your operations remain compliant and credible in the eyes of stakeholders and regulators.

Based on our analysis, we offer practical, Shariah-compliant recommendations. This may involve restructuring products, contracts, or business models to ensure both compliance and commercial effectiveness.

Successful Projects

Client Worldwide