Bridging Faith and Finance: Empowering Value-Based Intermediation Through Cash Waqf

Mr. Amine a dedicated businessperson has always thought that his financial success in life should impact society in a positive way hand in hand. He was intrigued when he heard about value-based intermediation (VBI), a mind-blowing approach in Islamic Finance that connects profits with purposes in Islamic Finance. But it was not until he also learned about the power of cash waqf within the VBI framework that he believed a way to turn his financial gains into lasting, meaningful change for his community and hereafter too. How can Islamic Financial Institutions (IFIs) harness cash waqf to create a better world? Let’s explore.

What is VBI?

An initiative by Bank Negara Malaysia (BNM), VBI is an intermediation function that aims to deliver the ultimate intended outcomes of Shariah through practices, conduct and offerings that create affirmative and sustainable outcomes for the economy, community and environment, maintaining consistency with the shareholders’ sustainable returns and long-term interests.

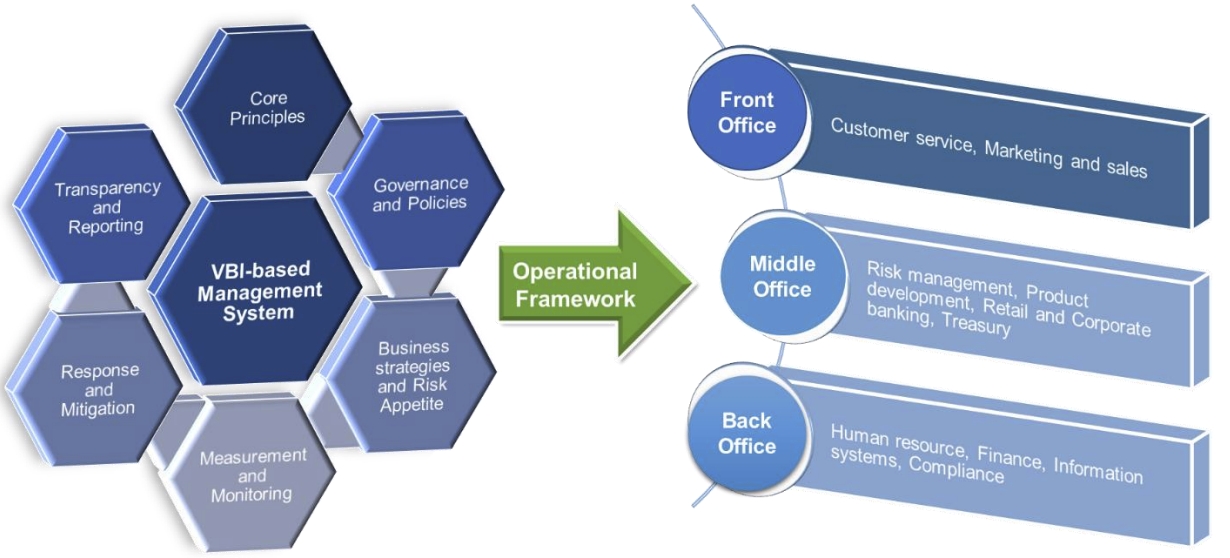

VBI-Based Management System Is A Guiding Framework To IFI’s Operations

Source: BNM Guidance Document on VBI

Why VBI Initiative Has Been Taken?

The Islamic banking system has been criticized for merely replicating conventional banking structures, imposing excessive ‘profit rates’ without due understanding, and not considering the institutions as business entities. Such misconceptions contradict the fundamental gist of Islamic Banking and finance discipline, which is to create a positive impact within society. Hence, the VBI initiative has been taken to maintain strong fundamental value generation within IFIs through proper self-discipline towards serving society with the help of redistributive instruments.

What is Cash Waqf?

Cash waqf is one of the types of Islamic endowment where individuals or organizations fund cash that is then invested, with the returns being used for charitable or social purposes, while, keeping the asset (cash) intact and protected. Traditionally, waqf has played a vital part in supporting education, healthcare, and other community services within the Islamic world.

Connection of Cash Waqf with Contemporary Islamic Finance

Cash waqf unlike traditional waqf which involves donating physical assets like lands or buildings, allows for the endowment of Money. The main value proposition that cash waqf provides is flexibility and that is why this instrument can be integrated within the modern Islamic financial tools with various structures.

Consider Adl Islamic Bank’s innovative cash waqf product. Imagine Mr Owais, a dedicated professional, contributing a portion of his savings to the waqf fund. Adl Islamic Bank invests this fund in Shariah-compliant ventures—like building schools in rural areas or providing microloans to small businesses. The beauty of this model? Mr Owais’s portion of the original contribution (Cash Waqf) remains untouched, while the profits continuously fund these impactful projects. This ensures his charity not only endures but also grows in its reach over time.

Realizing VBI within Cash Waqf Structures

For realizing VBI within cash waqf, a few essential steps can be taken:

- Strategic Collaboration: Establishing partnerships between Islamic financial institutions and Waqf institutions. This collaboration is crucial for overcoming challenges related to waqf property management, legal structures, and trust issues. The partnership should involve a joint management committee to supervise fund promotion, investment, distribution, and sustaining waqf funds.

- Inclusive Contribution Mechanism: Cash waqf permits contributors of all income levels to participate, promoting socio-economic justice. The inclusivity of cash waqf increases community participation.

- Tangible and Spiritual Benefit: Cash waqf provides perceptible benefits like funding for education, infrastructure and disaster relief. However, the donors will get spiritual relief, including the pleasure of Allah SWT and achieving socio-economic fairness.

- Public Private Collaboration: This can help address community issues better and circulate and distribute the cash waqf usufructs more effectively.

- Sustainable Development: Cash waqf contributes to businesses, start-ups, education and numerous projects, which accelerate the cycle of giving where beneficiaries can eventually become contributors.

- Governance and Transparency: Effective governance is mandatory to establish the trust of donors and transparent management of cash waqf. Proper impact reporting must be published by the IFIs.

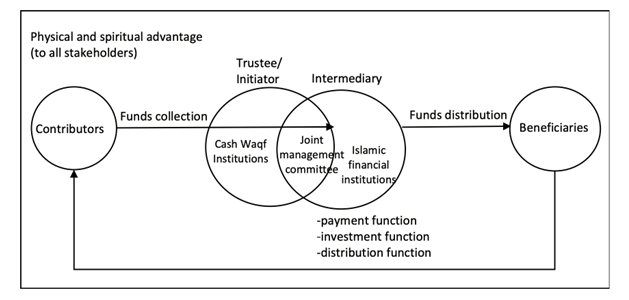

The framework of VBI Sustainability via Cash Waqf

Source: (Ishak & Zaini, 2024)

The chart above illustrates a sustainable cash waqf framework through VBI where contributors’ funds are collected and managed by a joint committee formed by cash waqf institutions and Islamic financial institutions. These funds are invested and distributed to beneficiaries, creating physical and spiritual benefits for all stakeholders. The chart highlights the importance of strategic partnerships, proper management, and risk mitigation to sustain the waqf funds. The model also suggests potential policy reforms, including the implementation of Wakalah contracts and collaboration with public or private institutions to enhance cash waqf sustainability.

Some VBI Cash Waqf Initiatives by the IFIs

- Bank Muamalat Malaysia Berhad (BMMB): Through the collaboration with Waqf Selangor Muamalat, Wakaf Negeri Sembilan and Wakaf MAIK Muamalat, medical equipment has been distributed to hospitals. Additionally, donations had been given to the schools. Through that VBI for health and education has been achieved.

- Affin Islamic: Waqf End Financing product, where the depositors may waive their deposit profit payment to participate in waqf financing for waqf housing projects such as Bank Islam and Wakaf Perumahan Pulau Pinang.

- Agro Bank: Agro Bank’s collaboration with Kolej Universiti Antarabangsa PICOMS, which involved cash waqf fundraising from the public (targeted RM200k) and direct funding from the Bank (RM400k) to acquire 15 dialysis machines.

- Waqf Featured Fund Models: As per SC Malaysia’s Waqf-Featured Fund Framework (2020), the endowed asset is not the unit trust itself, but rather the income or profit generated from the investment. The revenue or profits generated from the unit trust’s underlying assets would then be allocated for charity or religious purposes, as specified in the waqf’s terms and conditions. The list of Waqf Featured funds and waqf purposes are summarized below in the table:

Fund Type | Fund Name | Waqf Purposes |

Unit Trust | Makmur myWakaf Fund |

|

Unit Trust | PMB-An-Nur Waqf Income Fund |

|

Unit Trust | Kenanga Waqf AlIhsan Fund |

|

Unit Trust | Maybank Mixed Assets-I Waqf Fund |

|

Wholesale (for sophisticated/ high-net-worth investors) | Emergency Waqf Musa’adah Fund of Kenanga Sustainability Series | Emergency assistance in the event of climate change related disasters or future pandemics. |

Source: (Sulaiman et al., 2024)

Based on the above-mentioned practical examples, it is visible that by embracing VBI through Cash Waqf, IFIs have the power to transform their activities and daily operations into a force for good. That will not be only about making a profit but rather more about making a difference.

Next Step!!

Respected readers, imagine your investments impacting to society rather than just growing your wealth- imagine that self-satisfaction. Whether you’re an investor, a financial professional, or someone driven by a passion for ethical finance, now is the moment to act. VBI-aligned Cash Waqf doesn’t just support your financial goals with your values; it amplifies your impact on the world. Together, let’s not just talk about change—let’s create it. The future is in your hands—are you ready to make it brighter?

References:

1. Value-based Intermediation: Strengthening the roles and impact of Islamic finance. (2018). In Strategy Paper. Bank Negara Malaysia. Retrieved August 25, 2024, from https://www.bnm.gov.my/documents/20124/761682/Strategy+Paper+on+VBI.pdf/b299fc38-0728-eca6-40ee-023fc584265e?t=1581907679482

2. Ishak, A.H. & Zaini, N. (2024). Sustaining value-based intermediation initiative via cash waqf models. Turkish Journal of Islamic Economics, 11(1), 57-78.

3. Mahyudin, M. I., & Rahman, A. A. (2024). The application of Value-Based Intermediation through WAQF in Islamic Banking. The Journal of Muamalat and Islamic Finance Research, 174–184. https://doi.org/10.33102/jmifr.532

4. VALUE-BASED INTERMEDIATION FULL REPORT. (2021). In https://aibim.com/. Association of Islamic Banking and Financial Institutions Malaysia (AIBIM). https://aibim.com/contents/pages/value-based-intermediation/AIBIM-VBI-Full-Report-2021.pdf

5. Sulaiman, S., Shukor, S. A., Mursidi, A., & Aziz, M. R. A. (2024). Philanthropic Impact of investing via Waqf-Featured Unit Trust Funds: Determinant factors influencing the participation in Waqf Unit Trust Funds in Malaysia. ISRA International Journal of Islamic Finance, 16(S1), 24–45. https://doi.org/10.55188/ijif.v16is1.517